Originally published at The Whole Sky.

We did an estimate on how much our first year of having a baby cost. Four years and another baby later, we decided to do an update on how much the first five years have cost.

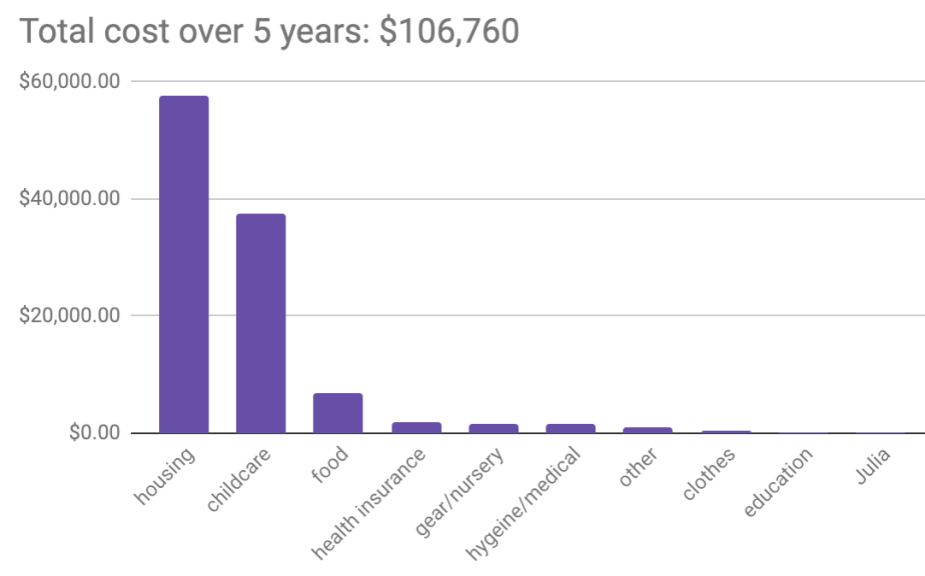

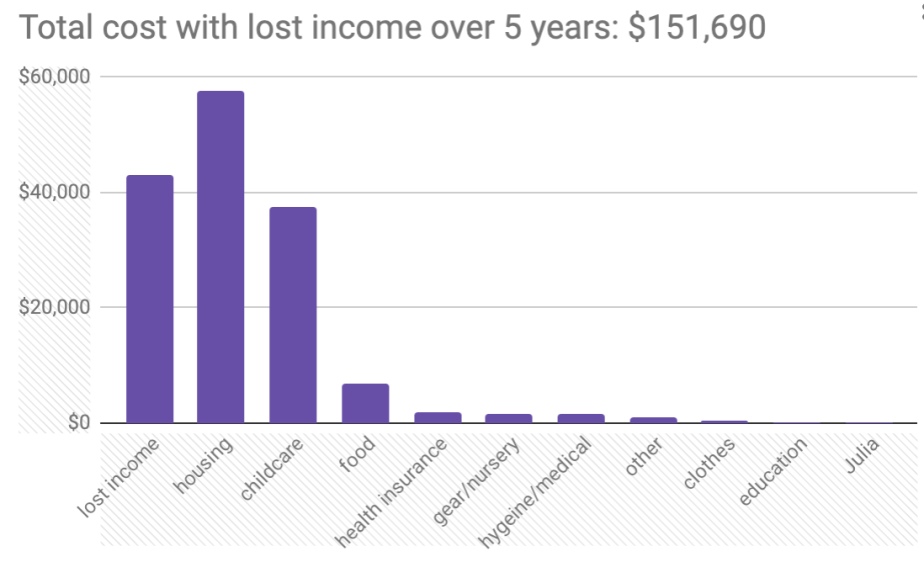

TL;DR: Over 5 years we’ve spent about $106,760 in cash, or about $150,000 including lost earnings. By far the biggest costs for us were housing, childcare, and lost wages of a stay-at-home parent.

Related posts:

Cost comparison of childcare

How much does it cost to have a baby? (at the one-year mark)

How much does it cost to raise kids? (speculation before we did it)

Total cost over 5 years:

Ok, this graph looks ridiculous because most categories are so much smaller than housing and childcare that you can’t see them, but that’s probably the point. People talk about baby gear and diapers costing money, but they just don’t hold a candle to the big two.

And that’s just counting what we paid in dollars. Here it is with my lost wages (post-tax) included:

So overall we’re about $151,690 short of what our child-free selves might have (assuming we neither donated nor invested the money). We’re also ahead by an unknown number of kisses and games of L-burrito.

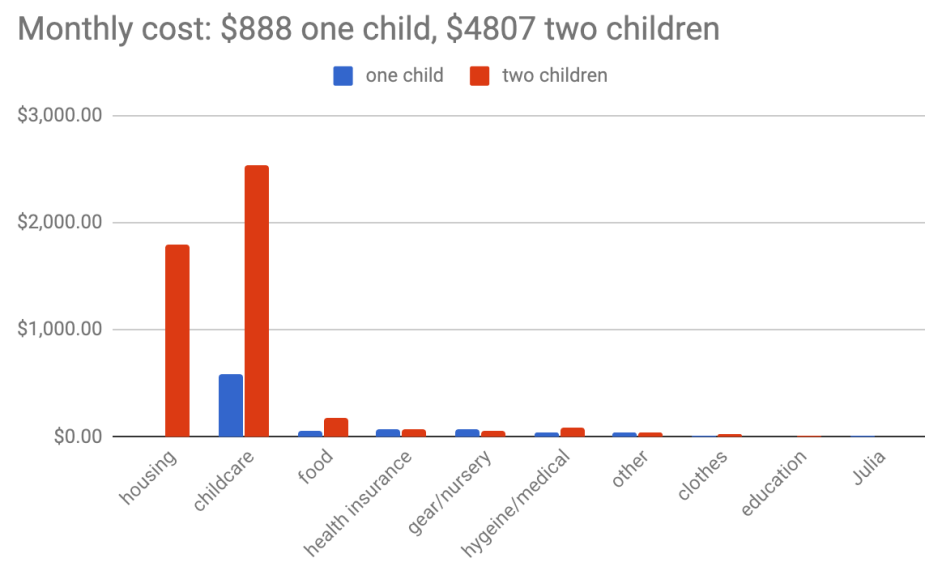

Monthly averages:

With the exception of buying a house, most of your costs don’t come all at once. So how to the costs actually come each month?

Some costs scale with having a second child and some didn’t. The biggest differences were 1) moving towards more paid childcare 2) moving to a house where each kid had a bedroom, instead of sharing our bedroom as L did for the first two years. Of course some of this is more affected by the passing time than by adding additional children — if we’d had just one child, we still would have moved her out of our bedroom around that time.

What’s in the categories:

- Housing: this is kind of pretend, because we actually built two extra rooms onto our house, which had a high up-front cost but will be useful for years and will eventually make the house sell for more. I’m instead substituting the cost at which we currently rent our spare bedroom ($900/month times 2 bedrooms). L got her own room around age 2 and A got hers around age 1, but I’m prorating it equally between them. This is one where you’ll be able to work out pretty easily what an extra bedroom costs where you live. Remember that your housing size won’t scale with your family size unless you move to a larger place every time you have a baby, so you’ll likely have some crowded years or some spare space.

- Childcare: payments to daycare providers, payments to nannies, au pair costs (stipend, agency fees, room, food, utilities, phone, and transit). The cost of the au pair room is estimated in the same way as the kids’ rooms above. Duplicate childcare while traveling (when either parent takes one child with them on a work trip).

- Food: additional food while Julia was pregnant and nursing. Minimal food during child’s first year. When we split food costs with housemates, we started counting the kids at half an adult share when they turned 1. This is probably an overestimate of what they eat.

- Health insurance: increase over what we paid for 2 of us to be on health insurance from Jeff’s work.

- Gear/nursery: cribs, rocking chair, stroller, etc.

- Hygiene/medical: diapers, bottle-feeding supplies, medicine, dentistry, vitamins, copays on medical appointments.

- Other: travel, toys, books.

- Education: books and materials for doing home preschool with L, and a summer program.

- Clothes: mostly from thrift stores or Swap.com.

- Julia: maternity and nursing clothes. The fact that I even thought this would be a significant category when we started tracking shows how vague my idea of our future expenses was.

More on lost wages:

During 2014-2017 I worked 2434 fewer hours, or about 60 fewer full weeks, than I expect I would have. After L’s birth I used my 13 days of vacation and sick time I’d hoarded from my social work job, and then quit and returned 5 months later. L lasted 3 weeks in daycare before getting kicked out because she wouldn’t drink milk for anyone but us (who knew that was a thing? To be fair, it’s unusual and your kid will probably be fine in daycare). So Jeff moved his schedule earlier, I worked evenings and weekends, and between us we took care of L constantly while working the equivalent of 1.6 jobs. More on that period. When she was 18 months we switched her to 4 days a week in daycare, and I worked 4 days and 2 evenings a week.

With A, we had a more normal setup. I took 7 weeks unpaid maternity leave, Jeff took 10 weeks paid paternity leave, and then both children were cared for by a nanny or au pair. Cost comparison of childcare arrangements we considered.

Things that may change your costs:

- Paid parental leave: Both times Jeff got 12 weeks paid leave and I got none. This is better than what most Americans get, but not so good by world standards.

- Opportunity cost: If a parent earning a lot takes unpaid leave or reduced hours, it’s a bigger difference from your previous income. If the parent wasn’t earning that much, it’s a smaller difference. If you’re in a field where taking extended leave will hurt your chance of promotion, etc, that’s an additional loss.

- Cost of childcare in your area: Boston has one of the highest childcare costs in the country, which is why an au pair (with nationally standardized costs) was the cheapest option once we had two kids. I don’t really understand why it varies so much by region. Also, different types of childcare vary in cost, quality, and convenience.

- Cost of living in your area: There are many places (including cheaper areas of our city) where a spare room costs less than $900/month, and some where it costs more.

- Sharing rooms: We could have moved to a three-bedroom place before having kids, which would have increased our costs. Or we could have stayed in a smaller space for longer — children having their own bedrooms has been unusual historically. But extended room-sharing means extended night feedings and (at least in our experience) more disrupted sleep for everyone. That’s one thing if you don’t need to do a lot of mental work during the day, but chronic sleep deprivation is no joke if your job requires you to think clearly. There are also other ways around this (baby in the bedroom and parents sleeping in the living room seems to happen a lot in San Francisco). Having children share with each other is another common option.

- Buying more or less stuff: We’ve kept costs pretty minimal here by buying used toys and clothes. Swap.com and similar sites are excellent for this.

- Preschool: we opted for minimal paid preschool because we were already paying for full-time childcare. We could either have put the kids in a daycare (the more expensive of which include preschool programming) or paid for L to go to morning preschool on top of the childcare we already had. The difference is whether someone is basically watching the kids play, vs. leading more organized group activities and having them learn letters, basic math, prewriting skills, etc.

- Vehicle: We have never owned a car, so kids really haven’t changed our transportation expenses. This is a cost to consider.

- Travel: The trips we take are now more expensive, but we take fewer of them, so I think this about evens out.

- Health insurance: Costs would be lower in a country with free health care, or higher if you don’t have an employer that covers as much of insurance costs as Jeff’s does.

- Health needs: children with special needs (medical, emotional, behavioral) need more of your time and more money for medical copays, services that aren’t covered by insurance, childcare that can handle their needs, etc.

How I want you to use this information:

To think about how much it may cost you or others to raise children. I particularly advise saving money before you have kids.

How I do not want you to use this information:

To criticize my family for our lifestyle or financial choices.

Hardly anyone publishes their budget. Please don’t disincentivize that.

[…] very expensive. People talk about saving for a child’s college education, but the more immediate cost is childcare until they start […]